Locking in target returns

- 09.11.23

- Markets & Investing

- Commentary

Drew O’Neil discusses fixed income market conditions and offers insight for bond investors.

A portfolio of individual bonds provides something that is somewhat unique in the investment world: a known outcome*. If held until the bond is redeemed (either by call or maturity), the annual yield earned for the life of a bond is known upfront at the time of purchase. Knowing the return on an investment upfront makes long-term financial planning a much easier task.

Many investors have a “target” return for their investment portfolio that, based on a range of assumptions, serves as a guidepost for a long-term financial plan. This is often further broken down into different target returns for different asset classes. While the fixed income target return might be different for every investor, a common target for many is 5%. This means that if an investor can earn 5% annually on the fixed income portion of their portfolio, their fixed income investments have essentially accomplished their goal.

For years, this 5% target proved elusive as the Fed kept the Fed Funds rate at historically low levels and Treasury yields mostly followed suit. An opportunity is presently available in the fixed income market that has been rare in recent memory: the ability to lock in yields greater than 5% for an extended period of time. To state the obvious: locking in a 5% (or greater) yield with a portfolio of individual bonds today means that the annualized yield is locked in and will not be affected by changes in interest rates. The longer the maturity, the longer the annualized yield is locked in. A 1-year bond yielding 5% locks in a 5% return for 1 year while a 10-year bond yielding 5% locks in a return of 5% every year for the next 10 years. Extending out and purchasing longer maturity bonds can make a lot of sense for a long-term financial plan right now, as the ability to lock in attractive yields for a longer period of time serves as a ballast for the overall portfolio for years to come.

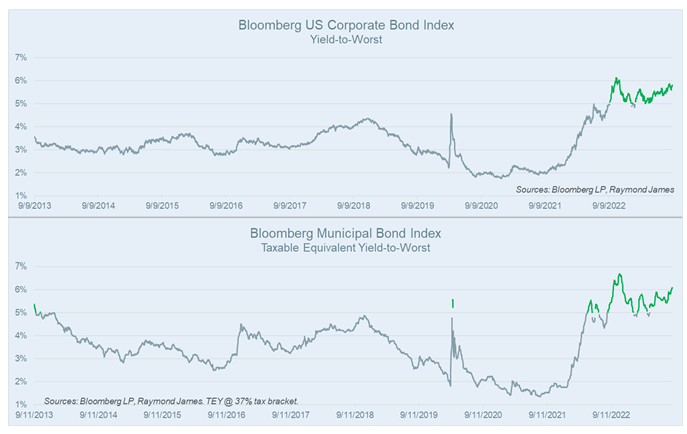

The charts to the left shine some light on the unique opportunity that is currently available relative to the past decade. The illustration assumes that an investor has a goal of 5% for their fixed income allocation. Shown on the top is the average yield of the Bloomberg US Corporate Bond Index and on the bottom is the taxable-equivalent yield of the Bloomberg Municipal Bond Index. While just a high-level snapshot, the portion of each line in green shows when locking in a 5% yield has been achievable.

The ability to achieve a target yield of 5% has not been the norm and if most interest rate forecasts are correct, may not be around much longer. For qualified money in retirement accounts or lower tax-bracket investors, the investment-grade corporate bond market is offering yields in the mid-to-upper 5% range that can hit yield targets and help solidify long-term financial plans. For higher tax-bracket investors with money to put to work in taxable accounts, municipal bonds are offerings taxable equivalent yields north of 6% (and north of 7% for investors in states with higher income tax rates). Don’t try to time the market… if you can achieve long-term goals with what is currently available, lock it in today.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Investment products are: not deposits, not FDIC/NCUA insured, not insured by any government agency, not bank guaranteed, subject to risk and may lose value.

To learn more about the risks and rewards of investing in fixed income, access the Financial Industry Regulatory Authority’s website at finra.org/investors/learn-to-invest/types-investments/bonds and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) at emma.msrb.org.